Valuation is a tricky business! In a world of perfect information all risks are known, alternatives can be compared with certainty and cashflows can be discounted to provide the value of a firm. AI could be used to accurately land on a valuation which accounted for all the factors. It is clear that such perfect knowledge is not in fact available especially for privately held SME firms. In practice the valuation process tends to proceed using comparatives (recent deals completed) and simple earnings multiples.

Multiples of EBITDA or cashflow or even turnover (in some sort of industry rule of thumb such as gross recurring fees) are used as an approximation. Although the price of any one share on the Stockmarket can vary from day to day it is clear that sectors tend to have price/earnings ratios which characterise them. Similarly for smaller private firms different sectors will have characteristics (based on sector’s trends, stability, desirability and prospects) which inform suitable multiples and these are most easily approximated by recent deals completed. Due to the lack of public information and liquidity these multiples used for private company valuations tend to be significantly lower than for quoted companies.

The relative strength of demand and supply determines the value of a firm’s shares freely traded between willing buyers and sellers. One issue for smaller firms is that the deal value is likely to be small so that sales commissions available will reflect that. Thus the quality and quantity of advice that can be give to buyers and sellers, and subsequent due diligence done on deals will mean that most sub-£1m businesses are simply valued using multiples between 1-3X. Of course the difference between 1 & 3 has considerable import for the seller.

Acquirers are basically buying the free cash from a business, ie a seller is selling their profit by multiples of future years. Much of the argument will be around what should be added back or subtracted from profits. Further these figures are probably not in the public domain. The comparison with other firms of similar size is a key way to fact check the claims on either side. USP Data contains the sector information which will be needed to fact check claims made and potential of a firm operating in the sector concerned.

Within any sector there will be winners and losers even if the total market size is static. If the market itself is expanding then all firms can prosper. However in a mature market there is likely to be consolidation whereby growth and economies of scale are sought by acquisition rather than by initiating new customers to the sector itself. This difference in market potential accounts for some of the variation of multiples which it is appropriate to use when valuing a firm in different sectors. As soon as customers are being won directly from competitors the nature of the rivalry has changed and competitive reactions to new sales or marketing initiatives are likely to be stronger.

Once you get over £1m revenues the multiples which might be used for valuations start to creep up. By the time you are at £5m revenues you might expect a business to be getting 4.5-5X. In “Buy & Build” investment strategies it is essential to know which other independent firms are currently operating in the sector to establish feasibility. It is important to know that there is the potential to consolidate enough firms of a particular profile to “move the needle” for the strategy to be effective.

You can see that the act of consolidating firms to make larger firms within a sector has the effect of improving the valuation multiples. Partly this is because of diversification of the risk. Over-reliance on individual employees or directors and/or in a small number of big customers will tend to depress valuations. Valuations will use multiples from the lower of the ranges suggested above if there is too much reliance on either. Also as a firm grows it tends to employ a more formal system which means it becomes less like a job for the director and more like a stand-alone investment with a predictable cashflow and consequently it becomes more attractive as a take-over target.

Within any sector firms approach the actual trading in different ways. Questions of the ownership or renting of premises and considerations of company debt will affect the Net Worth of the business. Indeed some firms will be valued for the assets themselves (perhaps desirable land or machinery) rather than as a going concern. It is important to establish just what assets on the Balance Sheet actually represent using a tool like USP Data. The question is: “does this setup actually confer any benefit to the business to a new owner?”. An alternative way of arriving at a business valuation is to approximate the entry cost. Estimates are made of the cost of developing a customer base and reputation, recruiting and training specialised staff, purchasing assets and licences and developing products and services. In comes down to ignoring the sunk costs and establishing what is crucial to a new business setting up to maximise value for shareholders today.

At the heart of any firm is a “business engine” or methodology which generates the cashflows and which is essentially what is being valued. This typically takes the form of the actual business practice and industry knowledge which is being employed. Take for example the sales funnel. All firms will have one, but how are suspects identified and qualified into leads in a cost effective way by this firm in this sector. In other words what works to drive sales predictably in this sector and what is simply not cost effective. A valuation will be at the high end of any multiple if the “business engine” is successful as exhibited by growth – particularly if that methodology is transferable. Spotting growing firms operating in sectors is key so that comparisons with industry benchmark averages can be done to confirm the rational of economies of scale within the sector.

Sometimes the technology or the capabilities of a particular product will drive the value of the business. The question of “value to who” will be important here since an excellent new product might be snapped up by an industry incumbent either to prevent disruption to existing business by retiring it or to capitalise by using the firm’s own existing route to market. Even within this idea complementary products will appeal to different buyers to different extents especially if they can widen or deepen existing customer relationships which as you know is likely to be where most profitable business occurs.

This brings us to the crucial importance of a thorough analysis of a firm’s customers. In a sense a valuation of a firm can be thought of as the value of acquiring the customer list. The health of this list and its potential is proof of the firm’s potential – and as we have seen in a world of imperfect information such solid verifiable facts are at a premium. A key part of a company valuation will therefore be an assessment of the existing customers. In the case of a trade buyer you will be looking for overlaps with existing markets and new markets that can be reached following an acquisition. Using a tool like USP Data to analyse the customer listing of prospective purchases should be a vital part of a valuation.

Conclusion.

With perfect information valuations would be easy. In the real world valuations particularly at the lower end are done typically using multiples of earnings which tend to be sector specific and are lower the smaller the size of the firm in question. Sector information is key to understanding both the potential and existing value of customers and the consequent valuation of the firm itself.

Contact us now to find out how USP Data can make UK SME business valuations easier

Latest articles

Enhancing Acquisition Success through Effective Business Segmentation

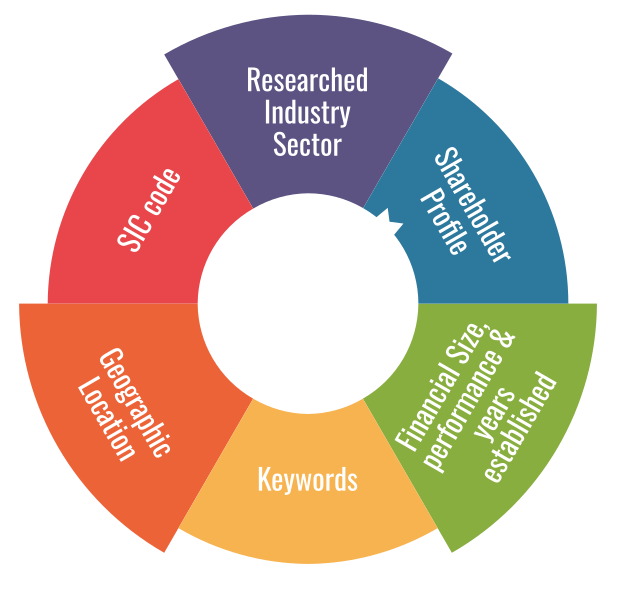

In the dynamic landscape of mergers and acquisitions (M&A), the process of business segmentation emerges as a critical component for identifying and evaluating potential targets. Business segmentation within the context of acquisitions involves the strategic categorization of target companies based on various criteria such as financial performance, geographic presence, industry sector, and shareholder profile. This…

Continue reading...Maximizing Business-to-Business Market Segmentation with Comprehensive Data

Understanding your target market is crucial for success in today’s ever-changing business environment. For B2B companies, effective market segmentation serves as the cornerstone of strategic decision-making and customer engagement. However, achieving precision targeting requires more than just surface-level insights. It demands leveraging comprehensive data, including researched industry sector reports, to optimize Business to Business market…

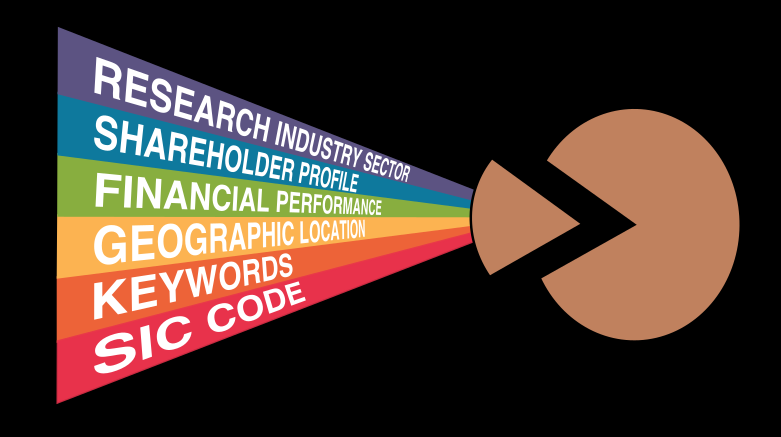

Continue reading...Leveraging Industry-Leading Firmographic Data Selections for Efficient Business Segmentation

Business segmentation plays a crucial role in tailoring marketing strategies, identifying target markets, and optimising resource allocation. However, the sheer volume of available data can overwhelm businesses, making it challenging to extract actionable insights efficiently. In this context, leveraging industry-leading firmographic data selections, encompassing SIC codes, researched listings, financial parameters, geographic parameters, keywords, and shareholder…

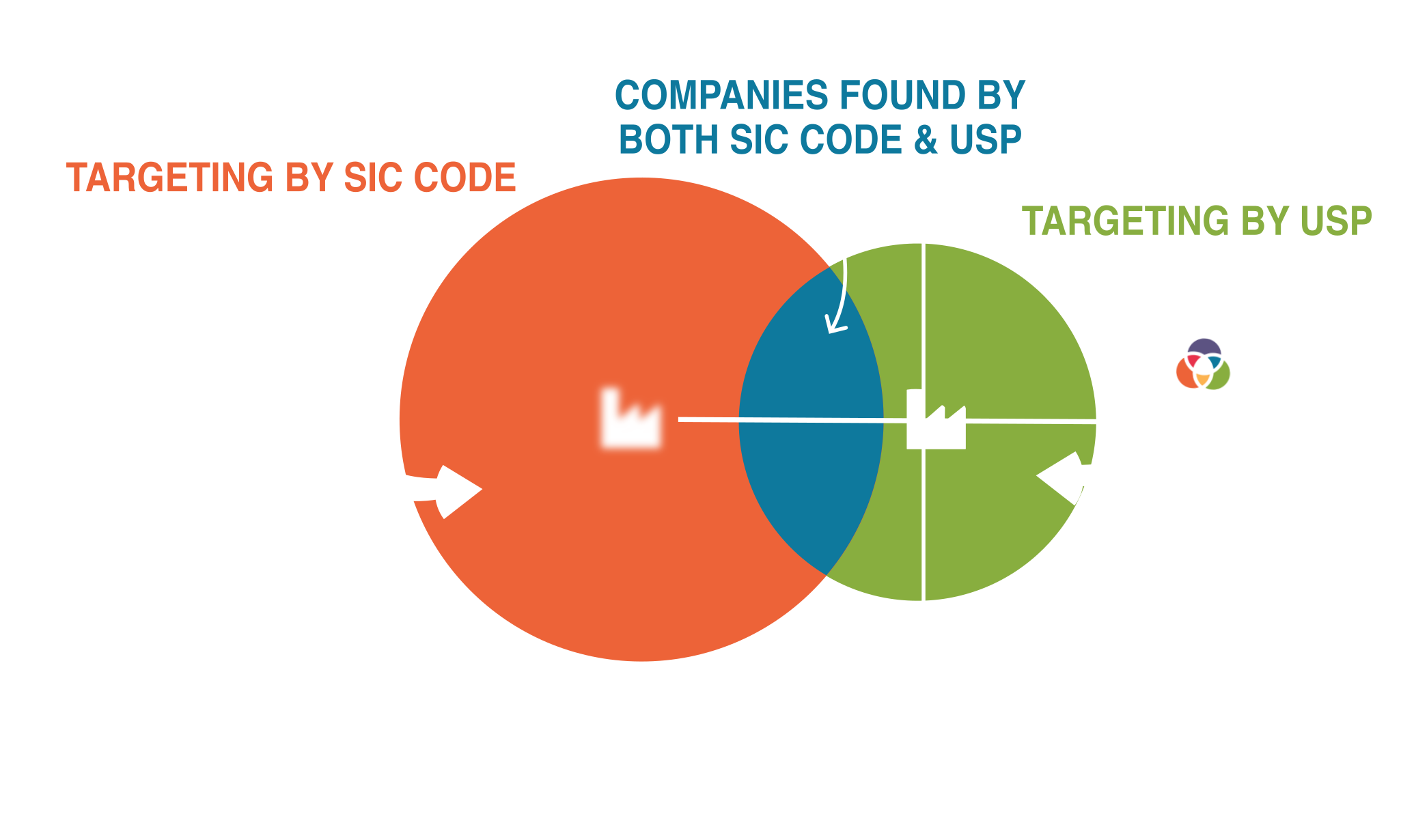

Continue reading...Enhancing Accuracy in Target Market and Market Segmentation: The Superiority of Researched Industry Sector Listings Over SIC Code Classifications

While Standard Industrial Classification (SIC) codes have traditionally served as a basis for industry classification, their limitations in accuracy, especially in a dynamic business environment, have become increasingly apparent. This article delves into the advantages of researched industry sector listings over SIC code classifications, with a focus on improving accuracy in classification. It examines how…

Continue reading...Find Company Information quickly with the USP Data App

Accelerating Deal Origination Deal Origination is made easier with the USP Data app. Because the universe of live UK companies is large we have included industry leading firmographic data selection tools to help you sift this mass of data to find company information you can rely on. The idea is that you can quickly screen…

Continue reading...Unveiling the Power of Niche Market Identification for Business Success

In a competitive SME business landscape, understanding and identifying relevant market niches is key. Of the 5 million plus limited companies live at Companies House there are probably only 1.7 million or so that are not dormant, intermediate holding companies or property management firms. This is still a considerable number to trawl through when attempting…

Continue reading...Converting your research to useful analysis

Just as a carpenter needs a saw in the toolbox to be taken seriously, anyone researching UK companies needs a tool like USP Data. Access to the latest information in an intuitive format is a pre-requisite if progress from research to analysis is to be swift. The definitive analysis of the list of suitable companies…

Continue reading...Shareholder Screening Guide

Shareholder profile can now be used as an additional screening criteria directly. SO the usual financial, geographic and sector seclections become subject to the selected shareholder profile such as age, and percentage of the shares. Using the templates you can extract the mailing addresses for the main shareholders for the shortlist of companies of interest…

Continue reading...Crm Upgrade Guide

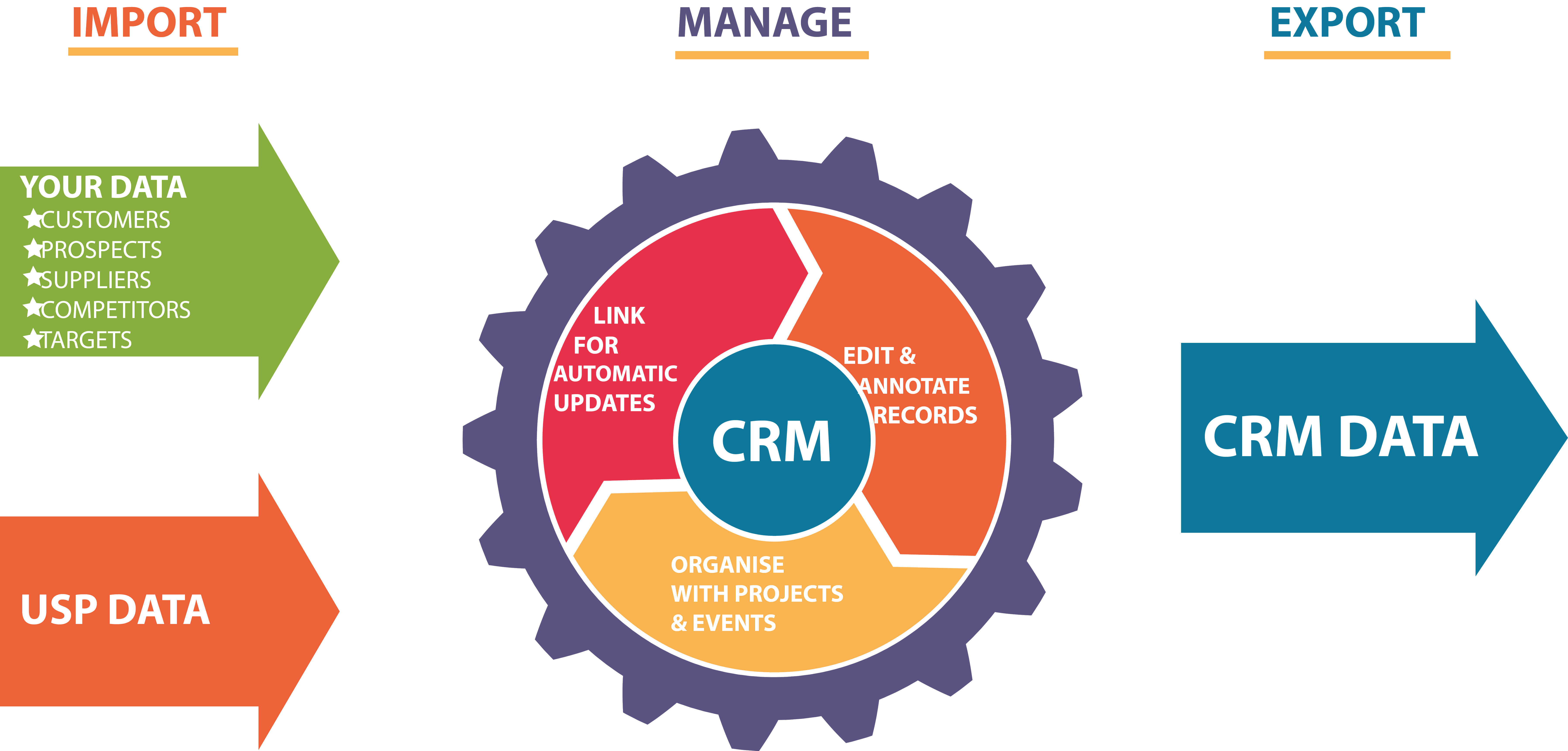

The CRM has received a significant upgrade in the latest edition of USP Data. The CRM remains the best place to save your work. CRM projects can be viewed directly on the list view and exported or pushed through one of the new templates you are able to define. A big change is the manner…

Continue reading...Data Templates Guide

Templates are a new addition to USP Data. The idea is that any data displayed in the List View can be viewed or exported using a template which you can define to exactly suit your purposes: You can select the exact data of interest from USP Data You can order the columns in the template…

Continue reading...Find Firm Improvements Guide

The Find a Firm side tab which provides access to the latest information on all the live companies at Companies House has been improved by: Allowing the search returns to run to 10,000 records rather than just 300 Listing the SIC code report as well as the researched report in which each company is listed…

Continue reading...High Quality Keyword Search

Using keywords can be a great to identify the companies likely to be of interest. Of course the quality of the data being searched needs to be high and even then care needs to be taken if keyword searches are to result in useful suggestions. The latest update to USP focuses on adding powerful options…

Continue reading...How to make Due Diligence easy

Assessment of business plans, corporate acquisitions or disposals and refinancing will all require due diligence investigations to confirm the facts being represented in the matter under consideration. This will require a tool or series of tools which allow an independent audit of the information being presented so that it may be confirmed in both hard…

Continue reading...Lead Building – sifting the wheat from the chaff

The sales funnel is a familiar concept which tracks the conversion of new contacts from suspects to leads to prospects and then to customers. This is typically represented as a cone with lots of leads being fed into the top of the cone and a much smaller number of customers resulting at the bottom. The…

Continue reading...Unlocking the opportunities hidden in abbreviated accounts

As you know Company Law allows “Small Companies” an option of disclosing less information at Companies House. This means that there is imperfect information in the public domain for SME firms. Companies House is the only verifiable source of financial data on privately held companies. As a result most of the attention is on the…

Continue reading...