Just as a carpenter needs a saw in the toolbox to be taken seriously, anyone researching UK companies needs a tool like USP Data. Access to the latest information in an intuitive format is a pre-requisite if progress from research to analysis is to be swift. The definitive analysis of the list of suitable companies from multiple lists sourced and combined during your research is the goal. Targeting companies with particular profiles in specific sectors and or geographic areas is the “meat and veg” problem address by USP Data. The product was designed to quickly focus in on shortlists for deal origination. Alternatively such a shortlist could be used to quickly identify other similar firms by sector or financial profile which might enhance your customer base.

The video below illustrates the process of turning your research into useful analysis. You can save, export or refine this analysis using USP Data.

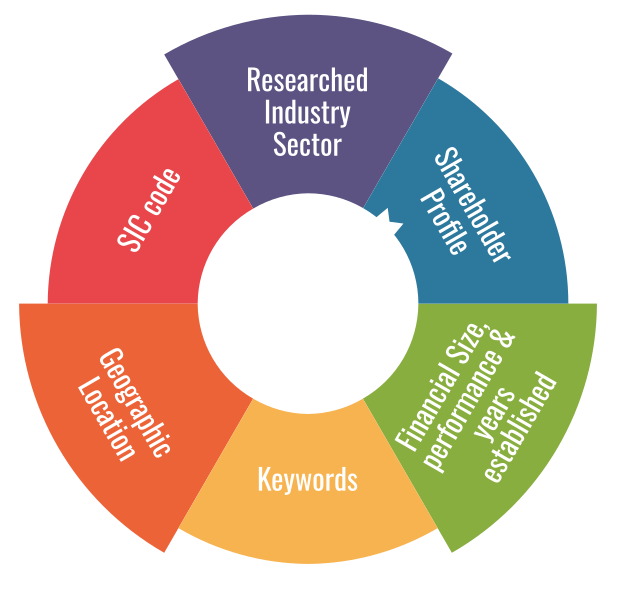

Research will typically start with a small number of named companies known to be of particular interest. These companies are operating in the market or sector of particular interest and the initial task is to find other firms that are the same. Internet research such as examination of the associated websites will result in some focused keywords. Using these keywords in Google will expand the initial listing and should result in the names of the obvious companies offering similar services.

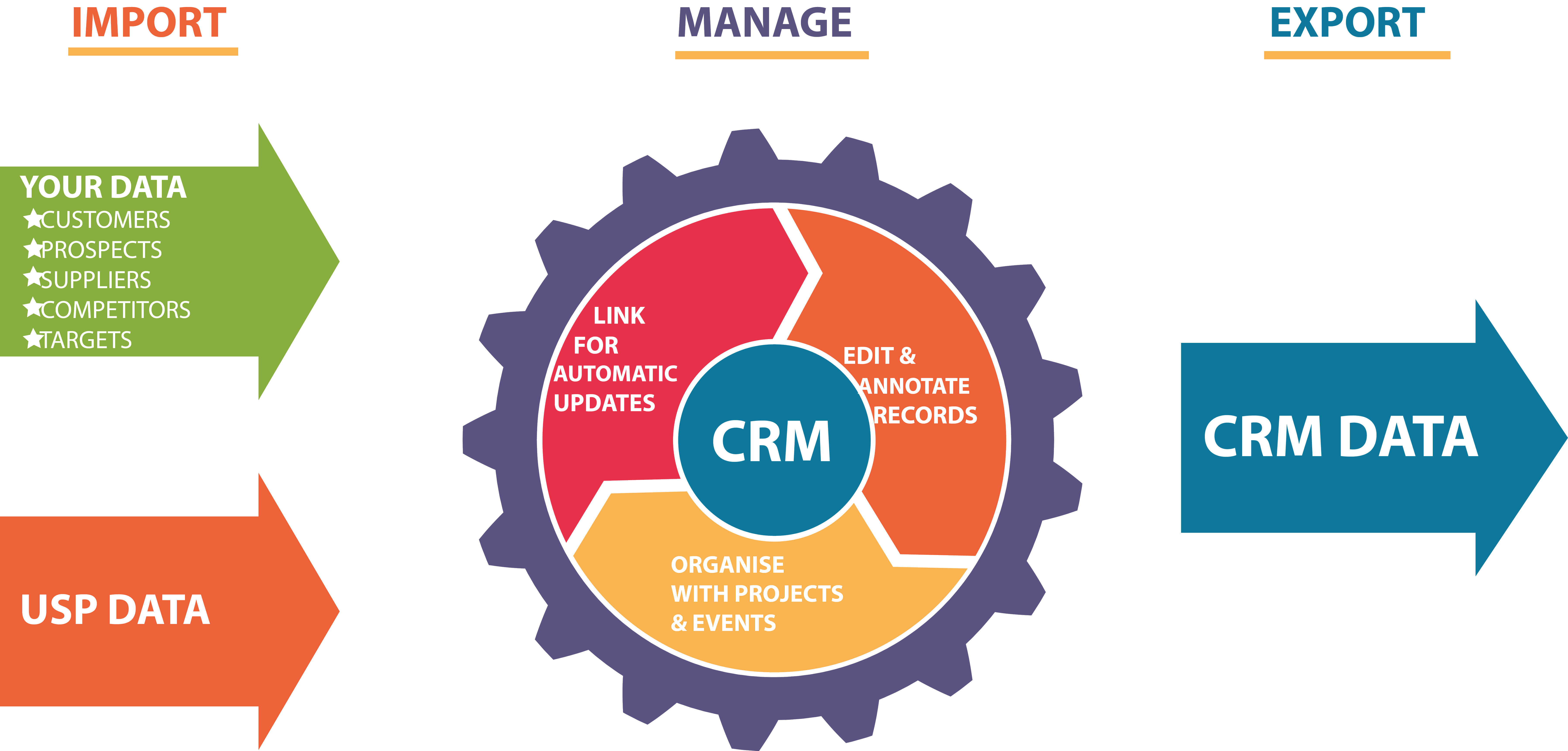

Having established a spreadsheet with this researched list as a starting point the next step is importing the list to USP Data. The auto lookup functionality can quickly establish the associated company numbers if they are not already known and this list will provide a suitable project list as a starting point once saved into the integrated CRM. The records can be managed and refined further at a later date – the best way to think of the CRM projects are like a scratch pad listing. This listing can be enhanced or used to generate contact listings or customised searches and reports including all the associated financials.

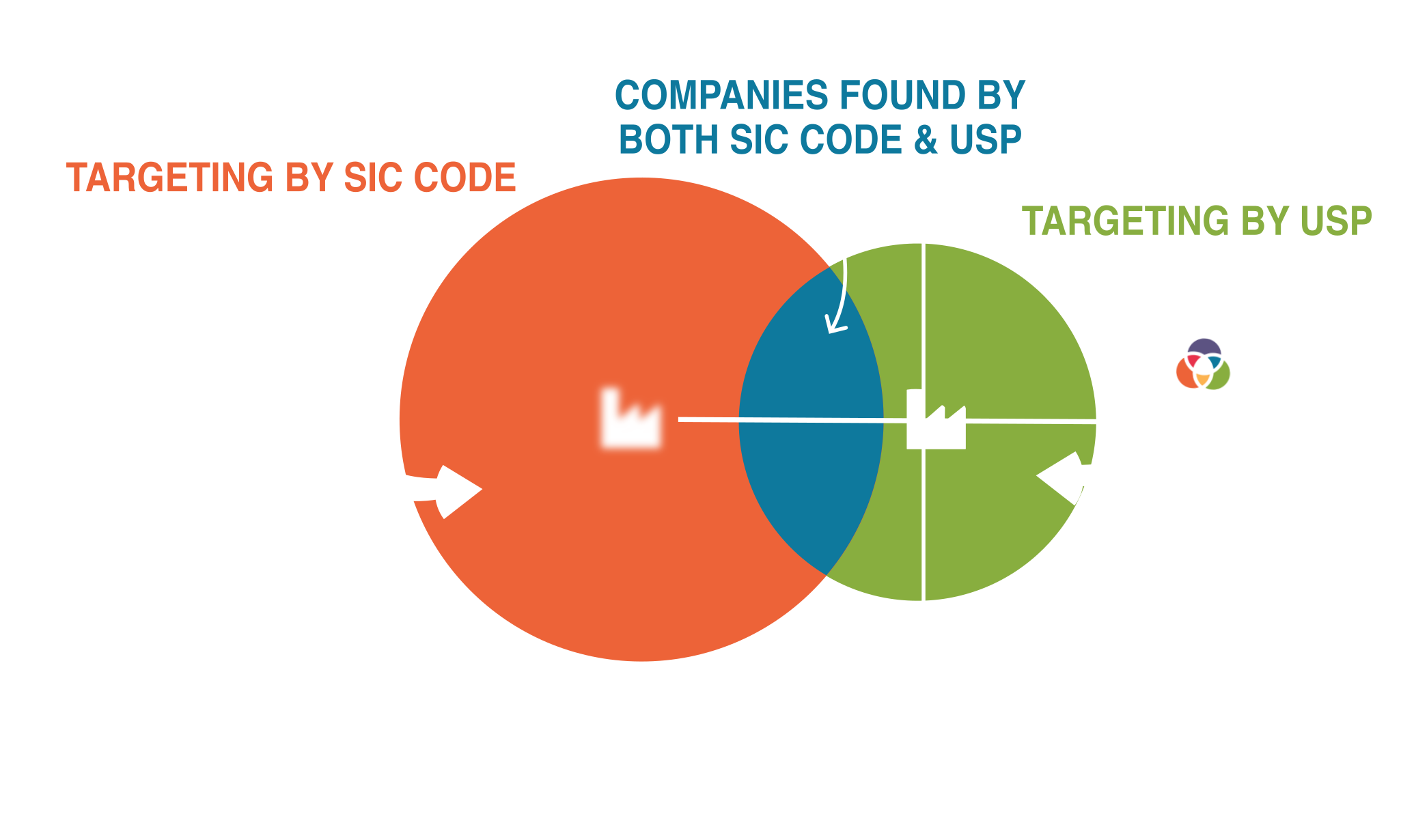

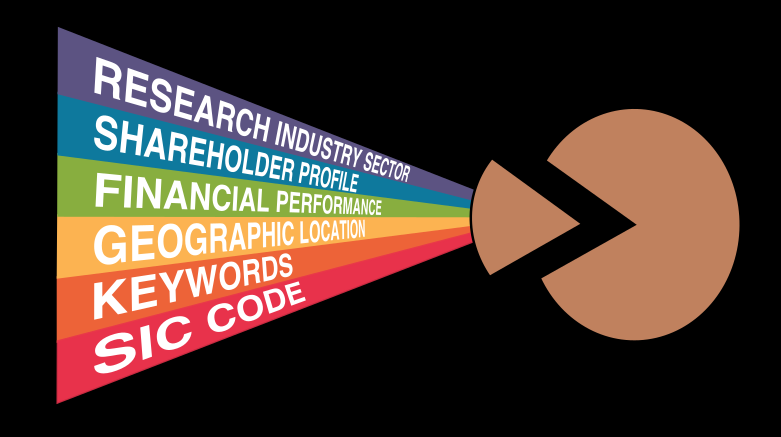

Now USP Data with the latest figures on some 4.8M firms comes into its own since it is easy to identify and combine existing researched industry sector listings or SIC code listings, your own previously saved customised listings and of course any project list that you have. Further, the pool of companies which are being considered can be expanded using keyword searches or refined by building suppression lists ensuring that the net is cast as widely as you deed fit to identify firms of likely interest. Note also that specific firms of particular interest can be nominated at any stage so that you can always include them. Think of this an inclusion list (ie as a mirror of the suppression list mentioned above) whatever the screening process applied the firms on your inclusion list will appear in your analysis.

So far you have a customised search listing of firms. You can can easily apply combinations of financial and geographic criteria to define the shortlist suitable for your needs. Screen criteria employed can include the age of the directors, the miles from a particular postcode the region or county and any combination of the 42 different financial criteria. The shortlist that results can be saved as a custom search thus generating a PDF report with rankings and averages and the associated spreadsheet data. A contact list can be exported with the director/shareholder of your choice. Best of all – the process is quick and intuitive and the analysis report created can be printed or viewed within minutes. Additionally this custom search will be kept current each week so that new financial or ownership data is incorporated into the analysis as it emerges.

Conclusion

The power of the USP Data application is the ability to combine research on UK limited companies from multiple sources into useful analysis in speedy intuitive ways.

Contact us now to find out how USP Data can help turn your research into useful analysis

Latest articles

Enhancing Acquisition Success through Effective Business Segmentation

In the dynamic landscape of mergers and acquisitions (M&A), the process of business segmentation emerges as a critical component for identifying and evaluating potential targets. Business segmentation within the context of acquisitions involves the strategic categorization of target companies based on various criteria such as financial performance, geographic presence, industry sector, and shareholder profile. This…

Continue reading...Maximizing Business-to-Business Market Segmentation with Comprehensive Data

Understanding your target market is crucial for success in today’s ever-changing business environment. For B2B companies, effective market segmentation serves as the cornerstone of strategic decision-making and customer engagement. However, achieving precision targeting requires more than just surface-level insights. It demands leveraging comprehensive data, including researched industry sector reports, to optimize Business to Business market…

Continue reading...Leveraging Industry-Leading Firmographic Data Selections for Efficient Business Segmentation

Business segmentation plays a crucial role in tailoring marketing strategies, identifying target markets, and optimising resource allocation. However, the sheer volume of available data can overwhelm businesses, making it challenging to extract actionable insights efficiently. In this context, leveraging industry-leading firmographic data selections, encompassing SIC codes, researched listings, financial parameters, geographic parameters, keywords, and shareholder…

Continue reading...Enhancing Accuracy in Target Market and Market Segmentation: The Superiority of Researched Industry Sector Listings Over SIC Code Classifications

While Standard Industrial Classification (SIC) codes have traditionally served as a basis for industry classification, their limitations in accuracy, especially in a dynamic business environment, have become increasingly apparent. This article delves into the advantages of researched industry sector listings over SIC code classifications, with a focus on improving accuracy in classification. It examines how…

Continue reading...Find Company Information quickly with the USP Data App

Accelerating Deal Origination Deal Origination is made easier with the USP Data app. Because the universe of live UK companies is large we have included industry leading firmographic data selection tools to help you sift this mass of data to find company information you can rely on. The idea is that you can quickly screen…

Continue reading...Unveiling the Power of Niche Market Identification for Business Success

In a competitive SME business landscape, understanding and identifying relevant market niches is key. Of the 5 million plus limited companies live at Companies House there are probably only 1.7 million or so that are not dormant, intermediate holding companies or property management firms. This is still a considerable number to trawl through when attempting…

Continue reading...Shareholder Screening Guide

Shareholder profile can now be used as an additional screening criteria directly. SO the usual financial, geographic and sector seclections become subject to the selected shareholder profile such as age, and percentage of the shares. Using the templates you can extract the mailing addresses for the main shareholders for the shortlist of companies of interest…

Continue reading...Crm Upgrade Guide

The CRM has received a significant upgrade in the latest edition of USP Data. The CRM remains the best place to save your work. CRM projects can be viewed directly on the list view and exported or pushed through one of the new templates you are able to define. A big change is the manner…

Continue reading...Data Templates Guide

Templates are a new addition to USP Data. The idea is that any data displayed in the List View can be viewed or exported using a template which you can define to exactly suit your purposes: You can select the exact data of interest from USP Data You can order the columns in the template…

Continue reading...Find Firm Improvements Guide

The Find a Firm side tab which provides access to the latest information on all the live companies at Companies House has been improved by: Allowing the search returns to run to 10,000 records rather than just 300 Listing the SIC code report as well as the researched report in which each company is listed…

Continue reading...High Quality Keyword Search

Using keywords can be a great to identify the companies likely to be of interest. Of course the quality of the data being searched needs to be high and even then care needs to be taken if keyword searches are to result in useful suggestions. The latest update to USP focuses on adding powerful options…

Continue reading...How to make Due Diligence easy

Assessment of business plans, corporate acquisitions or disposals and refinancing will all require due diligence investigations to confirm the facts being represented in the matter under consideration. This will require a tool or series of tools which allow an independent audit of the information being presented so that it may be confirmed in both hard…

Continue reading...Lead Building – sifting the wheat from the chaff

The sales funnel is a familiar concept which tracks the conversion of new contacts from suspects to leads to prospects and then to customers. This is typically represented as a cone with lots of leads being fed into the top of the cone and a much smaller number of customers resulting at the bottom. The…

Continue reading...Unlocking the opportunities hidden in abbreviated accounts

As you know Company Law allows “Small Companies” an option of disclosing less information at Companies House. This means that there is imperfect information in the public domain for SME firms. Companies House is the only verifiable source of financial data on privately held companies. As a result most of the attention is on the…

Continue reading...Valuing Companies Guide

Valuation is a tricky business! In a world of perfect information all risks are known, alternatives can be compared with certainty and cashflows can be discounted to provide the value of a firm. AI could be used to accurately land on a valuation which accounted for all the factors. It is clear that such perfect…

Continue reading...